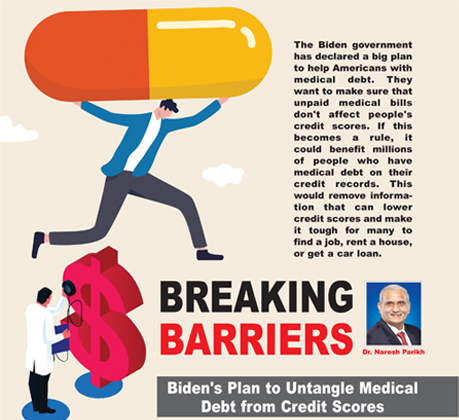

The Biden government has declared a big plan to help Americans with medical debt. They want to make sure that unpaid medical bills don’t affect people’s credit scores. If this becomes a rule, it could benefit millions of people who have

medical debt on their credit records. This would remove information that can lower credit scores and make it tough for many to find a job, rent a house, or get a car loan. 18 B

Biden’s Plan to Untangle Medical Debt from Credit Scores

The Biden government has declared a big plan to help Americans with medical debt. They want to make sure that unpaid medical bills don’t affect people’s credit scores. If this becomes a rule, it could benefit millions of people who have

medical debt on their credit records. This would remove information that can lower credit scores and make it tough for many to find a job, rent a house, or get a car loan.

These new rules would be a significant step to deal with medical debt, a problem that affects about 100 million people. It forces many to work extra, give up their homes, and limit their food and other basic needs. The Vice President,

Kamala Harris, along with Rohit Chopra, who leads the Consumer Financial Protection Bureau, announced these changes.

They believe that nobody in the country should go into debt just to get necessary healthcare. These measures aim to improve the credit scores of millions so that they can invest in their future. However, it will take some time before these

new rules come into effect, likely next year.

This move to limit credit reporting and debt collection by hospitals may face opposition from the industry. The Consumer Financial Protection Bureau, which was created after the 2008 financial crisis, is also facing challenges, especially from Republicans.

But this step by the Biden administration is receiving strong support from patient and consumer groups. They’ve been pushing for stronger protections against medical debt for a long time. Credit reporting, which is used to get patients to

pay their bills, is the most common tactic hospitals use to collect money.

A bad mark on a credit score might not be a big problem for some, but it can be really tough for those with large unpaid medical bills. It’s becoming clear that credit scores affected by medical debt can lead to problems like trouble

finding housing and even homelessness in some areas. Also, research suggests that medical debt doesn’t accurately predict a person’s creditworthiness, questioning its usefulness on a credit report.

Even though some big credit agencies have stopped including certain medical debts on credit reports, many patients with higher bills are still affected. Various groups have been urging the government to stop tax-exempt hospitals from

selling patient debt or denying care to people with overdue bills.

However, some hospital leaders and those in the debt collection industry worry that these restrictions might lead to unintended consequences, like more hospitals demanding payment upfront before providing care. Some also caution that easier

credit requirements could allow people to take out loans they might struggle to pay back.

The Background

Around 15% of adults in America have medical debt that they haven’t been able to pay off, says a recent study. Most of this debt is owed to hospitals. The research from Urban Institute, which leans towards left-leaning policies, discovered

that almost 73% of people with overdue medical bills owe some or all of it to hospitals. About 28% said all of their debt was from hospitals, while around 45% owed money to both hospitals and other healthcare providers.

The study showed that most adults with unpaid medical bills owed at least $1,000. One in five owed more than $5,000. People with overdue hospital bills tended to have higher levels of medical debt compared to those owing money to other

types of providers.

Michael Karpman, a key researcher at Urban Institute, emphasized, “These findings highlight the persistent challenge of medical debt in America, and the role of hospitals as a key source of that debt.”

The report also calls on the Biden administration to take stronger steps in reducing medical debt. It points out that this burden disproportionately affects those with lower incomes. The study revealed that a majority (60.9%) of adults with

overdue debt had been contacted by collection agencies. Interestingly, those at 250% of the federal poverty line were just as likely to be referred to collections as patients with higher incomes.

Lower-income individuals were not more likely to receive discounted care compared to wealthier individuals. Respondents at or below 100% of the federal poverty level were most likely to report having overdue medical bills. The analysis also

found that Black and Hispanic adults were more likely than white adults to report having overdue medical debt.

Gina Hijjawi, senior program officer at the Robert Wood Johnson Foundation, which supported the study, pointed out, “High rates of medical debt underscore the challenges millions of families and adults-especially families and adults

struggling to make ends meet-face trying to pay their medical bills.” She emphasized the need for protective standards to prevent excessive medical debt and to ensure access to affordable care.

Add Comment